Offering Document Under The Listed Issuer Financing Exemption

No securities regulatory authority or regulator has assessed the merits of these securities or reviewed this document. Any representation to the contrary is an offence. This offering may not be suitable for you and you should only invest in it if you are willing to risk the loss of your entire investment. In making this investment decision, you should seek the advice of a registered dealer.

Palladium One Mining Inc. is conducting a listed issuer financing under section 5A.2 of National Instrument 45-106 Prospectus Exemptions. In connection with this offering, the issuer represents the following is true:

- The issuer has active operations and its principal asset is not cash, cash equivalents or its exchange listing.

- The issuer has filed all periodic and timely disclosure documents that it is required to have filed.

- The total dollar amount of this offering, in combination with the dollar amount of all other offerings made under the listed issuer financing exemption in the 12 months immediately before the date of this offering document, will not exceed $5,000,000.

- The issuer will not close this offering unless the issuer reasonably believes it has raised sufficient funds to meet its business objectives and liquidity requirements for a period of 12 months following the distribution.

- The issuer will not allocate the available funds from this offering to an acquisition that is a significant acquisition or restructuring transaction under securities law or to any other transaction for which the issuer seeks security holder approval.

Palladium One Mining Inc.

What are we offering?

|

Type and Number of Securities Offered: |

Palladium One Mining Inc. ("Palladium" or the "Company") currently anticipates that it will offer an aggregate of up 15,000,000 units of the Company issued on a charity flow-through basis (the "Charity FT Units"). Each Charity FT Unit will consist of one common share of the Company (each, a "Charity FT Share") and one-half of one common share purchase warrant of the Company (each whole common share purchase warrant, a "Charity FT Warrant") each to be issued as a "flow-through share" within the meaning of the Income Tax Act (Canada). Each Charity FT Warrant will entitle the holder thereof to purchase one non flow-through Common Share (a "Warrant Share") at an exercise price of $0.20 for a period of 36 months from the date of issuance thereof. |

|

Offering Price: |

The Charity FT Units will be offered at a price of $0.20 per Charity FT Share (the "Charity FT Issue Price"). |

|

Closing Date: |

The Offering is expected to close in multiple tranches on or before December 20, 2022 (the "Closing Date"). |

|

Exchange: |

The common shares in the capital of the Company are listed for trading on the TSX Venture Exchange. |

What is our business?

The Company is an exploration stage company and engages principally in the exploration of mineral properties in proven, accessible and safe mining jurisdictions in Canada and Finland. The principal material project in which the Company currently holds a 100% interest is the Lantinen Koillismaa PGE-Cu-Ni-Project ("LK Project"), located in North-Central Finland. Additional projects in which the Company also holds a 100% interest include the Kostonjarvi Cu-Ni-PGE project ("KS Project"), located in North-Central Finland, and the Tyko Ni-Cu-PGE project ("Tyko Project") and Disraeli PGE-Ni-Cu project ("Disraeli Project"), near Thunder Bay, Ontario, Canada and the Canalask Ni-Cu project ("Canalask") located in the Yukon, Canada

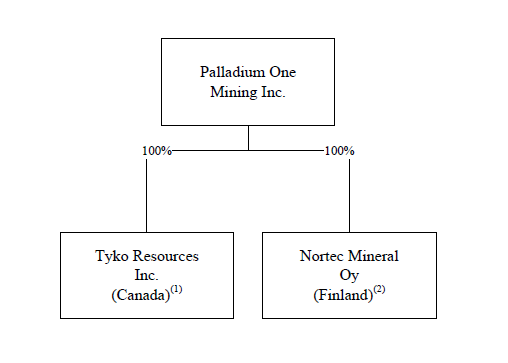

The following diagram illustrates the corporate structure of the Company and the location of the Company's principal assets within its corporate structure.

Notes:

(1) Tyko Resources Inc. holds the Tyko Project (as defined herein),Disraeli Project (as defined herein) and the Canalask Project (as defined herein)

(2) Nortec Mineral Oy holds the LK Project and the KS Project (as defined herein).

Further information regarding the business of the Company or its operations and its mineral properties can be found in the annual information form of the Company dated March 25, 2022, which is available for review under the Company's profile on SEDAR at www.sedar.com.

Recent Developments

On October 4, 2022, the Company reported preliminary assay results from the new West Pickle massive sulphide discovery. The Tyko Project hosts nickel, copper and cobalt, each of which has been designated a Critical Mineral in Canada, the United States and the European Union.

On November 17, 2022, the Company announced the grab sample assay and drone-based magnetometer survey results on the Canalask Nickel-Copper-PGE Project, located beside the Alaskan Highway in the Yukon, Canada. The samples returned over 2% nickel, 6% copper and 1.55 g/t gold. These results support a strong potential for massive nickel-copper sulphide mineralization.

On November 21, 2022, the Company announced additional assay results from the West Pickle zone of the Tyko Project, including 2.4 meters of 3.18% Ni, 0.99% Cu, 0.06% Co and 0.39 g/t Total Precious Metals.

On November 29, 2022, the Company announced the highest-grade drillhole intercept to date on the Tyko Project, from the West Pickle massive sulphide discovery in Ontario being 2.3 meters of 10.4% Ni, 3.4% Cu, 0.14% Co and 0.92 g/t Total Precious Metals.

What are the business objectives that we expect to accomplish using the available funds?

The principal business objective of the Company is the discovery and definition of mineral deposits for environmentally and socially conscious Metals for Green Transportation. That is, platinum group elements, nickel and copper. Using available funds, the Company intends to continue exploration at each of its LK, Tyko and Canalask projects.

What will our available funds be upon the closing of the offering?

|

Assuming 100% of offering |

||

|

A |

Amount to be raised by this offering |

$ 3,000,000 |

|

B |

Selling commissions and fees |

$ 180,000 |

|

C |

Estimated offering costs (e.g. legal, accounting, audit) |

$ 70,000 |

|

D |

Net proceeds of offering: D = A - (B+C) |

$ 2,750,000 |

|

E |

Working capital as at November 30, 2022 |

$ 7,312,000 |

|

F |

Additional sources of funding |

$ 1,000,000 |

|

G |

Total available funds G=D+E+F |

$ 11,062,000 |

How will we use the available funds?

Flow-through funds would be used at the Tyko Project for additional geophysical assessments, diamond drilling, mapping, surveying, sampling, assaying are planned.

Non-flow though funds are planned to be used to continue exploration and environmental studies at the LK project in Finland and for general corporate overhead.

Description of intended use of available funds listed in order of priority |

Assuming 100% of offering |

|

Corporate G&A including salaries, legal, audit and public listing costs |

$ 1,500,000 |

|

Tyko completion of 2022 drill program |

$ 311,000 |

|

Tyko 3,000m diamond drill program including drill contractor, assays and other related costs. |

$ 990,000 |

|

Tyko Gelophysics work including Mag and IP study |

$ 1,100,000 |

|

Tyko Mapping, prospecting & soil sampling |

$ 880,000 |

|

Tyko Data compilation & reporting |

$ 30,000 |

|

Canalask 3,000m diamond drill program including drill contractor, assays and other related costs. |

$ 990,000 |

|

Canalask Gelophysics work including BHEM and Ground EM |

$ 365,000 |

|

Canalask Mapping, prospecting & soil sampling |

$ 110,000 |

|

Canalask Data compilation & reporting |

$ 35,000 |

|

Unallocated working capital |

$ 4,751,000 |

|

Total |

$ 11,062,000 |

How have we used the other funds we have raised in the past 12 months?

100% of funds raised in the last 12-months has been allocated to exploration of the Tyko Project.

Tyko exploration expenditures are detailed in the table below:

Who are the dealers or finders that we have engaged in connection with this offering, if any, and what are their fees?

|

Agents: |

Echelon Wealth Partners Inc., on its own behalf and, if applicable, on behalf of a syndicate of agents |

|

Agents Commission: |

The Agents will receive a cash commission from the Company equal to 6.0% of the gross proceeds from the sale of the Offered Securities. |

|

Broker Warrants: |

The Company will issue to the Agents such number of broker warrants ("Broker Warrants") as is equal to 6.0% of the number of Charity FT Units sold under the Offering. Each Broker Warrant will be exercisable for a period of 24 months following the Closing Date into one Common Share (each a "Broker Warrant Share"), at the exercise price of $0.14 per Broker Warrant Share. The Broker Warrants and Broker Warrant Shares will be issued on a non-flow-through basis. |

Does Echelon Wealth Partners Inc. have a conflict of interest?

The Company is not a "connected issuer" or "related issuer", in each case within the meaning under National Instrument 33-105 Underwriting Conflicts, of Echelon Wealth Partners Inc..

Rights of Action in the Event of a Misrepresentation

If there is a misrepresentation in this offering document, you have a right

- to rescind your purchase of these securities with the Company, or

- to damages against the Company and may, in certain jurisdictions, have a statutory right to damages from other persons.

These rights are available to you whether or not you relied on the misrepresentation. However, there are various circumstances that limit your rights. In particular, your rights might be limited if you knew of the misrepresentation when you purchased the securities.

If you intend to rely on the rights described in paragraph (a) or (b) above, you must do so within strict time limitations.

You should refer to any applicable provisions of the securities legislation of your province or territory for the particulars of these rights or consult with a legal adviser.

Where can you find more information about us?

Prospective investors may access the Company's continuous disclosure information on SEDAR (www.sedar.com) under the Company's issuer profile and on the Company's website at https://palladiumoneinc.com.

Certificate

This offering document, together with any document filed under Canadian securities legislation on or after December 1, 2021, contains disclosure of all material facts about the securities being distributed and does not contain a misrepresentation.

December 1, 2022.

|

(signed) "Derrick Weyrauch" |

(signed) "Sara Hills" |