Palladium One, Kaukua South Chargeability Anomaly Expanded to Over Four Kms at LK PGE-Ni-Cu Project in Finland

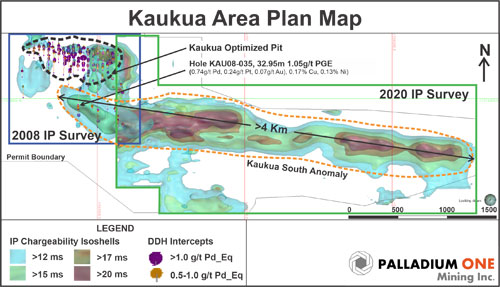

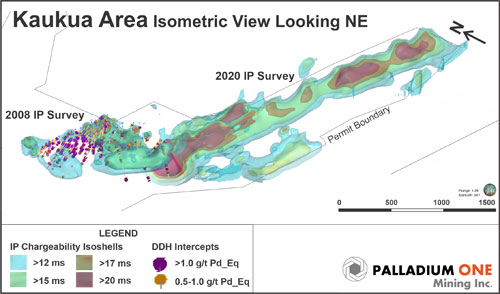

April 14, 2020 – Vancouver, British Columbia – Palladium One Mining Inc. (TSX-V: PDM, FRA: 7N11, OTC: NKORF) (the "Company" or "Palladium One") is very pleased to report that the Kaukua South Zone anomaly extends over more than a four (4) km strike length and into a large overburdened area that has never been drill tested. Final results from the first Induced Polarization (IP) survey grid, Kaukua East and the Infill grid (see news release February 25, 2020) have outlined this large chargeability anomaly, representing the eastern extension of the palladium dominant Kaukua South Zone. (Figure 1, 2 and 3)

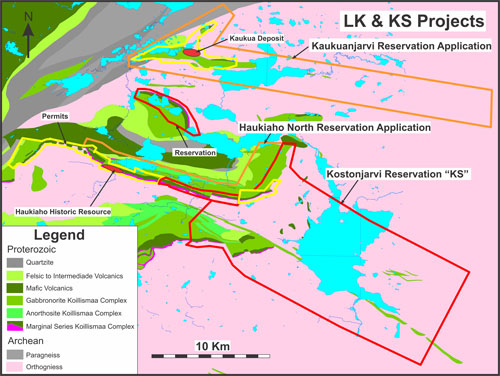

The Kaukua South anomaly extends to the eastern edge of Kaukua East IP survey grid, and the edge of the Exploration Permit boundary. As a result, the Company has applied for a 9,100-hectare Reservation (Kaukuanjarvi), (see press release April 2, 2020) covering the potential extension of the Kaukua South zone (Figure 4). A review of regional airborne geophysics indicates an east-west magnetic trend beyond the currently mapped extent of the Kaukua area mafic-ultramafic rocks, could be an extension of the Kaukua South mineralization. Reservations are granted for 1-2 years and have no holding costs.

Figure 1. Plan view of the 2008 and 2020 (current) IP survey in the Kaukua Area. The 2008 IP survey area is outlined in blue, while the 2020 survey is outlined in green. The Kaukua deposit's optimised open pit is outlined by a dashed black line (see details below). The newly expanded Kaukua South Zone south is outlined by a dashed orange line. The 2008 IP survey was instrumental in identifying the Kaukua Deposit. The 2008 survey used different equipment, consisting of a 3-line 3D system, whereas the 2020 survey used a 5-line 3D system, as a result the two surveys are not exactly comparable.

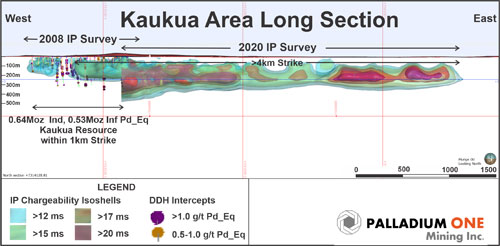

Figure 2. Long section view, looking north, of the Kaukua deposit and the newly expanded Kaukua South Zone chargeability anomaly.

Figure 3. Isoclinal view, looking northeast of the 2008 and 2020 IP surveys.

Figure 4. LK and KS Property map highlighting the new Reservation Applications. The LK property now consist of nine (9) permits, two (2) reservations and two (2) reservation applications totalling 16,260 hectares, while the KS project consists of 19,810 hectares.

In 2008, the lack of chargeability anomalies on the four eastern most lines of the 2008 IP survey suggested mineralization was cut-off to the east and therefore re-directed drilling by prior operators away from the area. However, several holes on the western side off the 2008 IP survey have highly anomalous Cu-Ni-PGE mineralization (e.g. hole KAU08-036, 29.3m 0.43g/t PGE (0.26g/t Pd, 0.04g/t Pt, 0.13g/t Au), 0.26% Cu, and 0.13% Ni) from 56.7 to 86m, these holes were never followed up further to the east (Figure 1, 2, and 3). The Kaukua South Zone anomaly has now been traced for over four kilometers, the eastern three quarters(¾) of which, are in an area of heavy overburden and have never been drill tested.

"Our first survey grid has successfully achieved the goal of identifying a large chargeability anomaly and provided the understanding that the Kaukua South zone extends for over four (4) kilometers east of proven mineralization. We have a clear opportunity to add significantly to existing Kaukua resource across kilometers of strike length. As hoped, we now have a significant drill target to aim at. The next step is to conduct a systematic drilling program to test the extent of mineralization.

With $2.6 million of cash on hand and no debt as at March 31, 2020 we are well positioned to reactivate our suspended, as a result of Covid-19, drilling program at LK when appropriate.

We are optimistic that the greater Kaukua area could have a much larger resource endowment than previously understood. Importantly, the chargeability anomaly remains open to the east of the survey grid and may continue onto the Kaukuanjarvi Reservation Application." commented Derrick Weyrauch, President and CEO

Qualified Person

The technical information in this release has been reviewed and verified by Neil Pettigrew, M.Sc., P. Geo, Vice President of Exploration and a director of the Company and the Qualified Person as defined by National Instrument 43-101.

About Palladium One

Palladium One Mining Inc. is a palladium dominant, PGE, nickel, copper exploration and development company. Its assets consist of the Lantinen Koillismaa ("LK") and Kostonjarvi ("KS") PGE-Cu-Ni projects, located in north-central Finland and the Tyko Ni-Cu-PGE property, near Marathon, Ontario, Canada. All three projects are 100% owned and are of a district scale. LK is an advanced project targeting disseminated sulphide along 38 kilometers of favorable basal contact. The KS project is targeting massive sulphide within a 20,000-hectare land package covering a regional scale gravity and magnetic geophysical anomaly. Tyko is a 13,000-hectare project targeting nickel dominated disseminated and massive sulphide is a highly metamorphosed Archean terrain.

The Kaukua deposit of the LK project hosts a pit- constrained resource of 635,600 Pd_Eq ounces of Indicated Resources grading 1.80 g/t Pd_Eq* ("palladium equivalent") contained in 11 million tonnes (@ 0.81g/t Pd, 0.27g/t Pt, 0.09g/t Au, (1.17g/t PGE), 0.15% Cu & 0.09% Ni), and 525,800 Pd_Eq ounces of Inferred Resources grading 1.50 g/t Pd_Eq contained in 11 million tonnes (@ 0.64g/t Pd, 0.20g/t Pt, 0.08g/t Au (0.92g/t PGE), 0.13% Cu, & 0.08% Ni), (see press release September 9, 2019). Kaukua is open for expansion, while the Kaukua South, Murtolampi and Haukiaho mineralized zones require systematic exploration via diamond drilling to follow up mineralized drill intercepts.

*Pd_Eq is calculated using the following metal prices (in USD) of $1,100/oz for Pd, $950/oz for Pt, $1,300/oz for Au, $6,614/t for Cu and $15,432/t for Ni.

ON BEHALF OF THE BOARD

"Derrick Weyrauch"

President & CEO, Director

For further information contact:

Derrick Weyrauch, President & CEO

Email: info@palladiumoneinc.com

Phone: 1-778-327-5799

Neither the TSX Venture Exchange nor its Market Regulator (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release is not an offer or a solicitation of an offer of securities for sale in the United States of America. The common shares of Palladium One Mining Inc. have not been and will not be registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from registration.

Information set forth in this press release may contain forward-looking statements. Forward-looking statements are statements that relate to future, not past events. In this context, forward-looking statements often address a company's expected future business and financial performance, and often contain words such as "anticipate", "believe", "plan", "estimate", "expect", and "intend", statements that an action or event "may", "might", "could", "should", or "will" be taken or occur, or other similar expressions. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, risks associated with project development; the need for additional financing; operational risks associated with mining and mineral processing; fluctuations in palladium and other commodity prices; title matters; environmental liability claims and insurance; reliance on key personnel; the absence of dividends; competition; dilution; the volatility of our common share price and volume; and tax consequences to Canadian and U.S. Shareholders. Forward-looking statements are made based on management's beliefs, estimates and opinions on the date that statements are made and the Company undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change. Investors are cautioned against attributing undue certainty to forward-looking statements.