Lithium hydroxide and nickel sulfate producers will rule the EV battery roost

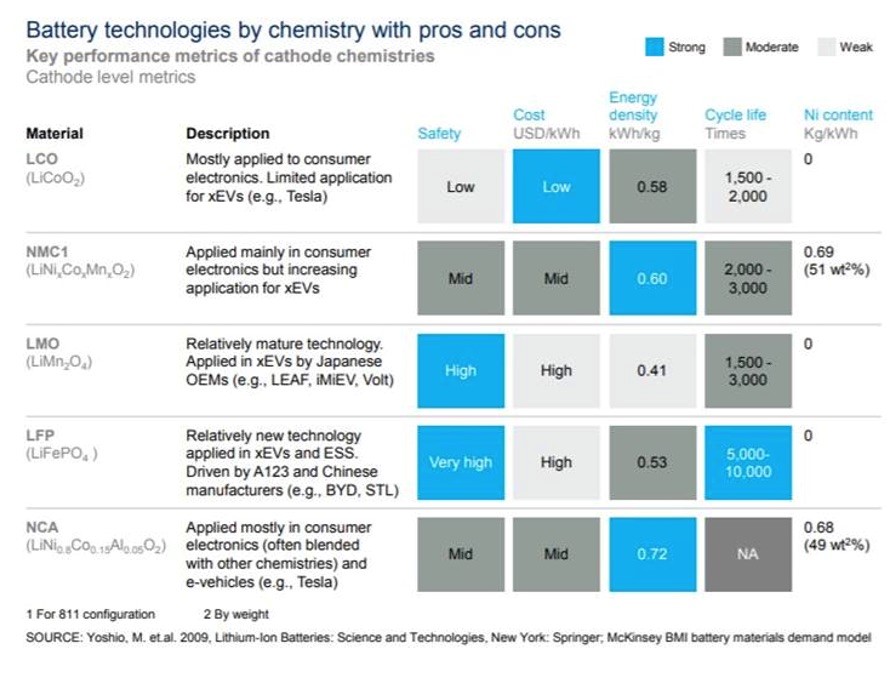

The lithium-ion battery has evolved over the years, incorporating new chemistries for different applications and increased performance.

There are now six types of Li-ion chemistries, all of which use lithium as a key ingredient. The difference lies in the compositions of other metals in the cathode, which could include cobalt, nickel, manganese, aluminum or lithium iron phosphate, depending on the battery’s application.

Comparison of Li-ion battery chemistries

In China, the world’s largest EV market, concerns about the driving range of EVs prompted the government to use subsidies to incentivize production of lithium-ion batteries with higher energy densities. This precipitated a switch, from battery cathodes containing lithium iron phosphate (LFP) material, to NCM and NCA compounds.

Out of these, the preferred chemistry for electric vehicles is a combination of lithium, nickel, cobalt and manganese (NCM) due to its low self-heating rate. However Tesla – the leading EV carmaker – currently uses an NCA chemistry (lithium-nickel-cobalt-aluminum), which has a long lifespan.

Because cobalt is so expensive, some battery makers are planning to change their battery chemistries to a higher percentage of nickel so they can use less cobalt.

The NCM cathode combination ratio is commonly 60% nickel, 20% manganese and 20% cobalt (6-2-2) but as battery technology advances, the percentage of nickel is going up; the most popular ratio is now 80% nickel, 10% cobalt and 10% manganese (8-1-1). Nickel therefore stands to benefit the most of all the battery metals from higher adoption of EVs and energy storage systems.

“NMC is used by nearly every automobile maker in the world save for Tesla. For at least the next decade, the evolution of the lithium ion battery and its NMC chemistry is towards a more nickel-rich cathode,” states a 2019 blog post by Benchmark Mineral Intelligence (BMI).

However, the higher nickel content presents challenges to the battery’s chemical stability. If the metals are used in either the 6-2-2 combination or the 8-1-1 ratio, the chemistry requires lithium hydroxide rather than lithium carbonate.

As explained in a 2019 article by Argus Media,

As nickel content approaches 60pc, the higher temperature required to synthesise cathode material with lithium carbonate damages the crystal structure of the cathode and changes the oxidation state of the nickel metal. But lithium hydroxide allows rapid and complete synthesis at lower temperatures, increasing the performance and lifespan of the battery, said Marina Yakovleva, global commercial manager for new product and technology development at lithium producer Livent.

Backing up a step, battery makers normally use one of two forms of lithium compound: lithium carbonate or lithium hydroxide. Lithium carbonate – which has a 19% lithium content – is largely produced from brines, while lithium hydroxide (29% lithium content) is commonly made from hard rock sources and is the preferred form for EV batteries. Both forms occur naturally, but their methods of extraction differ.

For lithium carbonate, the process involves pumping the brine into evaporation ponds, crystallizing the other salts out of the brine and leaving a lithium-rich liquor; this may take up to two years. Lithium carbonate is then produced after removing impurities, and the end product can be further processed into the higher-grade lithium hydroxide, but at an additional cost.

The most important lithium hard rock minerals are found in granitic pegmatites, which are intruding rock units formed from mineral-rich magma. Spodumene (in Greek meaning “burnt to ashes”), a lithium-bearing mineral that occurs as prismatic crystals in a range of colors, is most prevalent in pegmatites. The extraction process involves crushing and heating the rocks into powdered form, with the help of sulfuric acid, and then mixing in soda ash to create lithium hydroxide.

Other potential sources of lithium include lithium clays (non-hectorite) and petroleum brines (petrolithium), though commercial-scale production from these has yet to be realized (see the section on Cypress Development Corp below).

Nickel market tightening

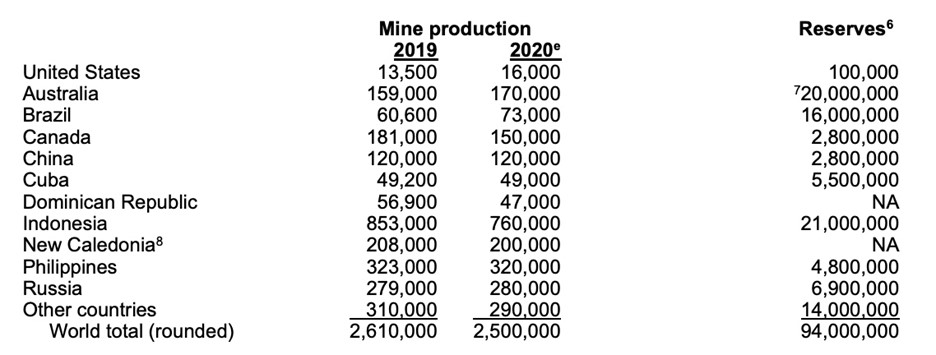

According to CRU, the commodity market analysis firm, nickel usage in batteries is expected to grow seven-fold, from 70,000 tonnes in 2017 to 240,000 tonnes in 2023, a compound annual growth rate (CAGR) of 20%. The Bank of America projects that 13.6 million EVs sold in 2025 would need 690,00 tonnes of new nickel supply. That represents nearly the entire mined supply of Indonesia, the world’s top nickel producer, which in 2020 outputted 760,000 tonnes.

Source: USGS

The majority of nickel usage, around 70%, goes into stainless steel production, however this is expected to change dramatically over the next decade. According to CRU, current global primary nickel demand was approximately 2.2 million tonnes per annum for 2018 and is expected to grow to 2.8 million tonnes by 2023. Mined nickel production in 2020 was only 2.5 million tonnes, meaning if the market doesn’t see an annual supply increase of at least 300,000 tonnes in the next two years, it will slip into deficit.

BMI notes that nickel is different from other battery metals in its inability to respond quickly to a supply crunch, due to the fact that bringing on a new large scale nickel mine can often run into the billions of dollars…

Combine that with the fact that nickel projects had massive cost overruns in the last cycle (in fact one can argue that nickel projects destroyed more value than any other commodity in the last cycle), many of those very projects struggle even today, and you have the real prospect that investors will not provide the capital to build new nickel mines any time soon thus ensuring a tight nickel market in years to come.

Nickel sulfate

Producing nickel-rich battery cathodes requires high-purity nickel, in the form of nickel sulfate, derived from high-grade nickel sulfide deposits.

However, right away there is a problem, in that the majority of today’s nickel production is nickel pig iron (NPI) used in steelmaking (also known as ferro-nickel), which is ill-suited for making batter-grade nickel.

It’s important to note that less than half of the world’s nickel is suitable for the biggest growth market — EV batteries.

Another problem is the rarity of nickel sulfide deposits.

Nickel deposits come in two forms: sulfide or laterite. About 60% of the world’s known nickel resources are laterites, which tend to be in the southern hemisphere. The remaining 40% are sulfide deposits.

Nickel sulfide deposits, the principal ore mineral being pentlandite (Fe,Ni)O(OH), are formed from the precipitation of nickel minerals by hydrothermal fluids. They are also called magmatic sulfide deposits. The main benefit of sulfide ores is that they can be concentrated using a simple physical separation technique called flotation.

Nickel laterite deposits — the principal ore minerals are nickeliferous limonite (Fe,Ni)O(OH) and garnierite (a hydrous nickel silicate) — are formed from the weathering of ultramafic rocks and are usually operated as open pit mines. There is no simple separation technique for nickel laterites. The rock must be completely molten or dissolved to enable nickel extraction. As a result, laterite projects require large economies of scale at higher capital costs to be viable. They are also generally much higher cash-cost producers than sulfide operations.

Yet large-scale sulfide deposits are extremely rare. Historically, most nickel was produced from sulfide ores, including the giant (>10 million tonnes) Sudbury deposits in Ontario, Canada, Norilsk in Russia and the Bushveld Complex in South Africa. However, existing sulfide mines are becoming depleted, and nickel miners are having to go to the lower-quality, but more expensive to process, as well as more polluting, nickel laterites such as found in the Philippines, Indonesia and New Caledonia.

Map of nickel sulfide and laterite deposits

According to BloombergNEF, demand for class 1 nickel is expected to out-run supply within five years, fueled by rising consumption by lithium-ion electric vehicle battery suppliers.

BNEF analysts note that sales of passenger EVS rose 43% in 2020, a pandemic year, and they forecast a record 4.4 million units will sell this year. Demand for nickel from lithium-ion batteries is expected to surge 16-fold to 1.8 million tons by 2030, BNEF said in a July 2020 report, with batteries accounting for more than half of class 1 nickel demand, “shifting a market that’s currently focused on stainless steel.”

Heavily polluting laterites

One way to address the coming supply shortage, is to mine plentiful laterites and convert the nickel product into nickel sulfate, as the Chinese are planning to do in Indonesia.

Reuters has reported on the multi-billion-dollar Chinese-led project to produce battery-grade nickel chemicals, that Indonesia hopes will attract EV manufacturers to the country. At least four high-pressure acid leach (HPAL) plants are currently under construction, led by Chinese stainless steel producers and battery makers.

The world’s largest stainless steelmaker, China’s Tsingshan Group, plans to supply nickel matte, an intermediate nickel product based on converted nickel pig iron (NPI), to Chinese companies, who will further process it into nickel sulfate.

Trial production of high-purity (>75% Ni) nickel matte began nearly a year ago at its facilities on the Indonesian island of Sulawesi, allowing Tsingshan to claim it has the capability of producing high-grade matte on a regular basis.

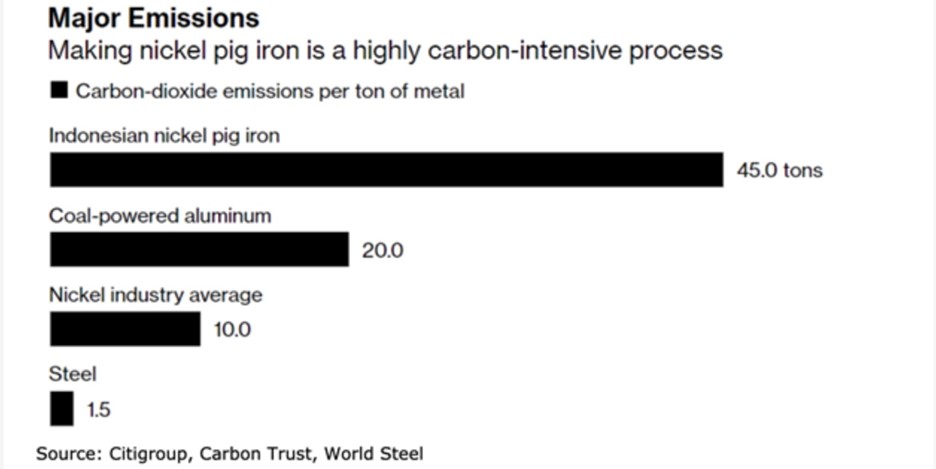

The problem is, producing nickel sulfate for EV batteries using either HPAL or from nickel matte, are extremely dirty processes that negate any notion of mining companies being “green”.

HPAL – whose performance record has been highly mixed — involves processing ore in a sulfuric acid leach at temperatures up to 270 degrees C and pressures up to 600 psi to extract the nickel and cobalt from the iron-rich ore; the pressure leaching is done in titanium-lined autoclaves.

Counter-current decantation is used to separate the solids and liquids. Separating and purifying the nickel/cobalt solution is done by solvent extraction and electrowinning.

The advantage of HPAL is its ability to process low-grade nickel laterite ores, to recover nickel and cobalt. However, HPAL is unable to process high-magnesium or saprolite ores, it has high maintenance costs due to the sulfuric acid (average 260-400 kg/t at existing operations), and it comes with the cost, environmental impact and hassle of disposing of the magnesium sulfate effluent waste.

As Indonesia ramps up its mining sector to feed the world’s hunger for zero-emission vehicles, it is faced with a problem: what to do with all the waste. The country’s answer is sure to sour even the most ardent convert to electric-vehicle technology: it lets mining companies dump their tailings waste into the sea, a practice known as Deep Sea Tailings (DST).

According to Benchmark Mineral Intelligence, producing 1 kilogram of nickel from laterite ore requires having to treat 100 kg of ore, whether by HPAL, evaporation or heap leach methods. In other words, 1 kg of Ni produces 99 kg of acid containing iron waste, that cannot be used as a byproduct. NPI/ ferronickel plants do not have this issue, nor do nickel sulfide operations.

Not only do established nickel miners in Indonesia plan to continue the environmentally egregious practice of DST, due to cost considerations, the process of refining nickel to make nickel pig iron, and now, nickel matte, is highly energy-intensive (it relies on coal-fired power) and creates a lot of air pollution.

According to the graph below, producing 1 ton of nickel in nickel pig iron creates 45 tons of carbon dioxide emissions, compared to just 20 tons for coal-powered aluminum and steel production requiring an average 2 tons of CO2 per ton of metal.

With nickel more carbon-intensive than aluminum, zinc, copper, lead and steel, in that order, automakers are questioning whether they want to have anything to do with Indonesia’s dirty nickel processing methods, especially in light of the increased importance to most corporations of environmental, social and governance (ESG) practices.

“The technology is definitely real, but does not meet ESG standards,” Bloomberg quotes Jon Lamb, portfolio manager at metals and mining investment firm Orion Resource Partners, referring to the nickel matte production process. “As consumers are focused on the lifecycle carbon intensity of their supply chains it is difficult to see how this production would earn a spot in these supply chains.”

Another Bloomberg article has a great quote from mining magnate Robert Friedland, who stated during a recent industry event:

“The automobile industry is not going to nuke hundreds of thousands of acres of tropical jungle in Indonesia and dump the tailings in the ocean and try to convert ferronickel into batteries. That’s disinformation or whistling in the dark.”

The sulfide cupboard is bare

Where will mining companies look for new nickel sulfide deposits, from which the extraction of high-grade nickel needed for battery chemistries is economically, technically and environmentally feasible? The pickings are slim.

BMI asserts that New nickel production to fuel the EV revolution will come from a handful of sulphide deposits (such as Turnagain or Dumont) or from the abundance of laterites in Indonesia, Philippines, Australia and New Caledonia — but immediately rejects the laterite production as uneconomic.

Decades of under-investment equals few new large-scale greenfield nickel sulfide discoveries. Only one nickel sulfide deposit has been discovered in the past decade and a half, Nova-Bollinger in Western Australia.

The result of such limited nickel exploration is a very low pipeline of new projects, especially lower-cost sulfides in geopolitically safe mining jurisdictions. Any junior resource company with a sulfide nickel project will therefore be extremely attractive to potential acquirers.

At AOTH, we have two companies that are developing nickel sulfide deposits, both in Canada.

Renforth Resources (CSE:RFR, OTC:RFHRF, WKN:A2H9TN) continues to make good progress at its Surimeau nickel-copper-zinc property in Quebec. The brownfield project covers an area of 215 square kilometers south of the Cadillac Break, a prolific gold structure, and is among current and former producing mines.

In April, the company completed a 16-hole, 3,500m drill program at Victoria West, a nickel-rich volcanogenic massive sulfides (VMS) target that has been explored historically and by Renforth over a strike length of 5 km within a 20-km-long magnetic anomaly associated with intrusives.

To date, Renforth has successfully drilled off 2.2 km of strike length. A thousand meters of drilling and field prospecting is planned for Surimeau starting this month, as the company awaits assays from the recently completed drill program.

Palladium One’s (TSX.V:PDM, FSE:7N11, OTC:NKORF) Tyko nickel-copper-PGE property near Marathon, Ontario, contains twice as much nickel as copper, and equal amounts of platinum and palladium.

According to Palladium One, the high tenor of the sulfide minerals suggests a valuable concentrate could be produced, and that even if the sulfides are disseminated, the deposit could still be economic.

The 2020 drill program was designed to test the Smoke Lake electromagnetic (EM) anomaly. A drone-based magnetic survey also pinpointed a strong bullseye associated with soil anomalies (up to 565 ppm nickel and greater than 40 times background levels), representing the surface expression of the EM anomaly.

Mineralized boulders with high nickel (up to 0.41% Ni) and copper values were discovered, indicating potential for high-grade massive sulfide mineralization.

This potential was validated by the first two diamond drill holes, which intersected 4m and 2m of massive magmatic sulfides, respectively, both at less than 30m true depth.

This was the first confirmed occurrence of massive sulfides on the Tyko project. All 13 holes drilled at Smoke Lake intersected magmatic sulfides, with widths ranging from 1 to 15 meters.

A second-phase, 2,000m drill program started in April, following up on high-grade hits of 9.9% nickel equivalent (NiEq) over 3.8m – US$1,765.70 tonne at today’s price of US$8.09/lb and 6.3% NiEq (US$1,123 tonne) over 0.9m, published on Jan. 19.

These are some of the highest nickel grades in the world.

On April 28 PDM announced that 11 of 14 holes completed so far intersected massive sulfides, ranging from 1.3 to 5m in length.

According to Palladium One, the most significant result of this Phase 2 drill program, was the linking of massive sulfide mineralization in the “upper conductor” with the “lower conductor” (see image below). The lower conductor has been confirmed to host massive to semi-massive sulfide mineralization (hole TK-20-024 returned 6.27% Ni over 0.9m (US$1,118 tonne), potentially adding additional high-grade intercepts. The upper conductor was tested in the Phase 1 drill program.

Drilling confirmed continuity along the 350-meter strike length, thus increasing the scale of known nickel-copper mineralization.

On June 17 PDM announced it has intercepted more high-grade nickel at Tyko, including 6% nickel-equivalent over 5m, in a second conductor confirmed to host high-grade massive to semi massive sulfide mineralization.

This summer’s exploration activities will include Borehole Electromagnetic (“BHEM”), horizontal loop EM and regional airborne magnetic and EM surveys, as the company’s expanded program centers on new target development, infill drilling, and expansion of known high-grade nickel mineralization at the Smoke Lake zone.

Lithium hydroxide

As mentioned, the higher nickel content in industry-leading nickel-cobalt-manganese (NCM) batteries, presents challenges to the battery’s chemical stability. If the metals are used in either the 6-2-2 combination or the 8-1-1 ratio, the chemistry requires lithium hydroxide rather than lithium carbonate.

The future of lithium-ion batteries therefore envisions two key raw materials: nickel sulfate and lithium hydroxide.

According to Chilean state lithium miner SQM, demand for lithium carbonate is expected to rise at a CAGR of 10-14% from 2018-27, while lithium hydroxide demand is seen climbing at a 25-29% CAGR.

Trade flows reflect the increasing use of lithium NCM cathodes, with Argus Media quoting data showing that China imported 20,394 tonnes of NCM oxide from South Korea and Japan in 2018, up from 9,142t in 2017 and 2,352t in 2015:

That change in demand is prompting producers to expand their lithium hydroxide output and shifting mining projects towards developing lithium hydroxide production rather than lithium carbonate.

Where will the lithium hydroxide come from? The economics do not favor lithium brine operations, which must produce lithium carbonate as the first step of a two-step process.

In contrast, lithium hydroxide can be made directly from the lithium-bearing mineral spodumene in lithium hard rock mines such as those found in Australia — Greenbushes is the biggest.

Argus Media reports, The cost of producing lithium hydroxide from spodumene rock deposits is below the cost of production from brines, and in future hydroxide will account for the majority of lithium produced, said Infinity vice-president of European corporate strategy and business development, Vincent Ledoux Pedailles.

Prices rising

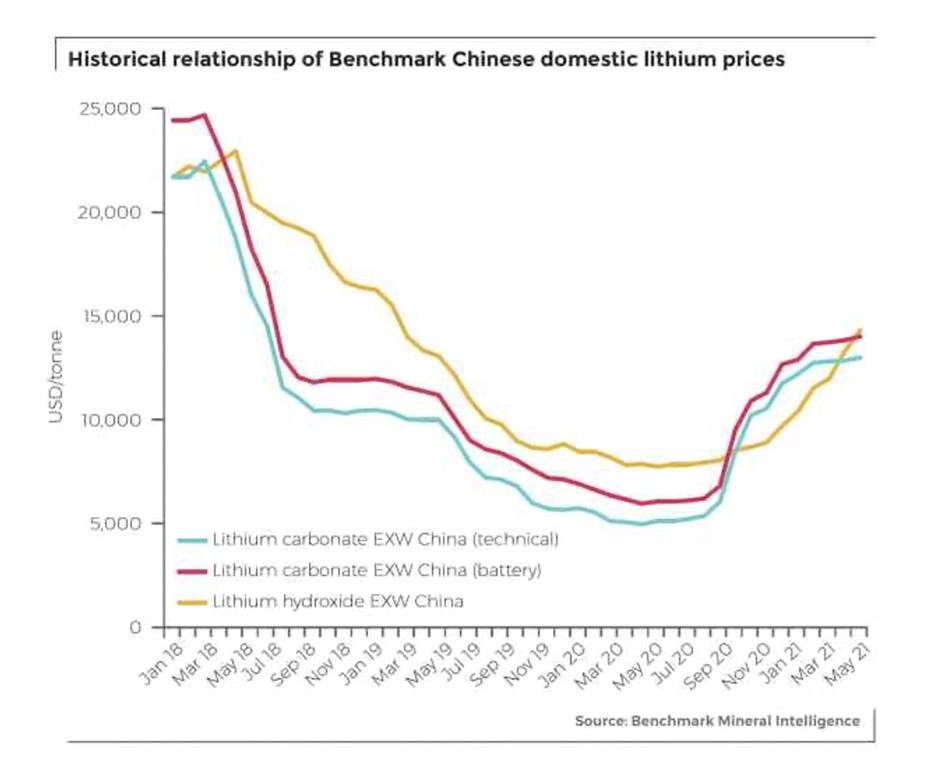

The good news for lithium producers, is that lithium hydroxide prices are now higher than lithium carbonate, thus incentivizing production.

Wasn’t this always the case? Well, yes, but recently, carbonate prices out-paced their hydroxide rivals.

As Benchmark’s May 2021 Lithium Price Assessment explains it, In January 2021, carbonate prices rallied on strong demand from LFP cathode manufacturers, inverting the historical relationship as hydroxide pricing moved to a discount on battery-grade carbonate.

The carbonate rally was largely driven by demand from the global EV market, helped by covid-19 stimulus programs, and resurging demand for LFP cathodes, which utilize lithium carbonate in the production process.

In mid-March, Benchmark notes that Chinese carbonate prices enjoyed their highest premium, of $3,000 above hydroxide prices, compared to the normal $1,000 to $1,500 premium, which represents the conversion cost.

The tables were turned in April-May, when lithium hydroxide prices in China gained 33.3%, versus a 5.5% increase in lithium carbonate prices.

In May, Chinese lithium hydroxide prices averaged $14,275 per tonne, against $13,975/t for lithium carbonate, a trend Benchmark believes will continue, owing to a large extent due to the demand for NCM batteries requiring lithium hydroxide:

Benchmark forecast NCM cathodes to represent over 75% of cathode market share by 2030, with well over half of these being the 811 high-nickel variety, meaning demand for lithium hydroxide is only set to rise further and challenge the already delicate supply-demand balance, supporting Benchmark’s expectations of further rising prices in the Chinese domestic hydroxide market.

The lithium market intelligence firm says demand for lithium hydroxide continues to rise as production of high-nickel cathode cells has begun to climb, alongside processors preferentially sourcing hydroxide – where possible taking advantage of the comparatively cheaper chemical – boosting demand for hydroxide and reversing this short-lived discount to carbonate.

The firm also notes that production of NCM and NCA cathode cells has been ramping up in China, with the country averaging 6.1 gigawatt hours (GWh) per month so far in 2021, compared to a two-year average in 2019 and 2020 of 4.3GWh per month.

The bright outlook for lithium hydroxide demand and prices is great news for lithium miners that produce the battery cathode ingredient, as well as explorers with deposits amenable to hydroxide production.

At AOTH, our pick in the lithium space is Cypress Development Corp (TSXV:CYP, OTCQB:CYDVF, FSE: C1Z1), which owns the Clayton Valley lithium project in southwest Nevada.

The property covers 5,430 acres and is located immediately east of Albemarle’s Silver Peak mine, North America’s only lithium brine operation, which has been in continuous operation since 1966.

The prefeasibility study showed a potential 40-plus-year operation capable of producing 27,400 tonnes of lithium carbonate equivalent (LCE) at an industry-low cash cost of $3,400 per tonne.

The company is currently working towards a feasibility study and permitting of a mine and metallurgical facility for its large deposit of lithium-bearing claystone.

Should everything go according to plan, Clayton Valley would become a viable source of high-purity lithium hydroxide (LiOH) suitable for EV battery usage for decades.

In March, Cypress took a vital step in advancing the Clayton Valley project towards production by announcing the development of a lithium extraction pilot plant for the lithium-bearing claystone.

The pilot plant is located at a metallurgical facility south of Beatty, Nevada, owned and operated by del Sol Refining Inc., which is permitted under the State of Nevada for chemicals use with permits in place with the US Environmental Protection Agency (EPA).

The initial operation of the pilot plant will focus on chloride-based leaching to confirm the results of the company’s scoping study on lithium extraction.

The pilot plant is planned to operate at a rate of one tonne/day and will be designed for correct interaction and testing of the major components within the extraction process and assessment of the resulting lithium products.

According to Cypress, the program will provide essential data for a planned feasibility study and enable the company to produce marketing samples to support negotiations with potential offtake and strategic partners.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Renforth Resources (CSE:RFR) or shares of Palladium One (TSX.V:PDM). RFR and PDM are paid advertisers on Richards site aheadoftheherd.com

Richard owns shares of Cypress Development Corp (TSXV:CYP).